Health

Get coverage for expensive health setbacks so you can focus on getting better.

{{title}}

{{label}}15 June 2015

There is no question that every mother dreams to see her children grow up to be self-sufficient and financially stable. But how do we guarantee their security, when quality education grows more expensive every year, and more and more parents are forced to drop their children from school due to a lack of necessary funds?

In 1997, this precise challenge hit Ms. Monserrat V. Delos Reyes. After leaving her job in the medical field as a nurse, she was unsure if she could afford to pay the tuition fees of her children. “It was a difficult time,” Delos Reyes narrated. “I was constantly worried about our expenses, most of all how I could possibly pay for the schooling of my kids.”

Fortunately, Delos Reyes found a highly rewarding career as a financial advisor for Philam Life. With full belief in both the products she was selling and company providing them, she bought an education plan with a very specific purpose in mind. “My daughter Regine always dreamt of studying in De La Salle University and becoming a lawyer,” Delos Reyes explained. “I wanted to secure my daughter’s future, regardless of whatever unexpected turns life would throw at me,” she enthused.

In 2007, Monserrat’s investment was fully returned, and Regine was able to take up a degree in Economics at De La Salle University. She continued to receive checks twice a year from Philam Life, which were able to pay for three trimesters’ worth of Regine’s tuition every year. Since Regine’s course took only three years to complete, Delos Reyes was able to use the fourth year of her educational plan payout to cover other family expenses.

“It felt like a huge weight was lifted off of my shoulders. I had the peace of mind that Regine’s education was taken care of and assured by Philam Life. I couldn’t be happier with my choice of investment,” the proud mother beamed.

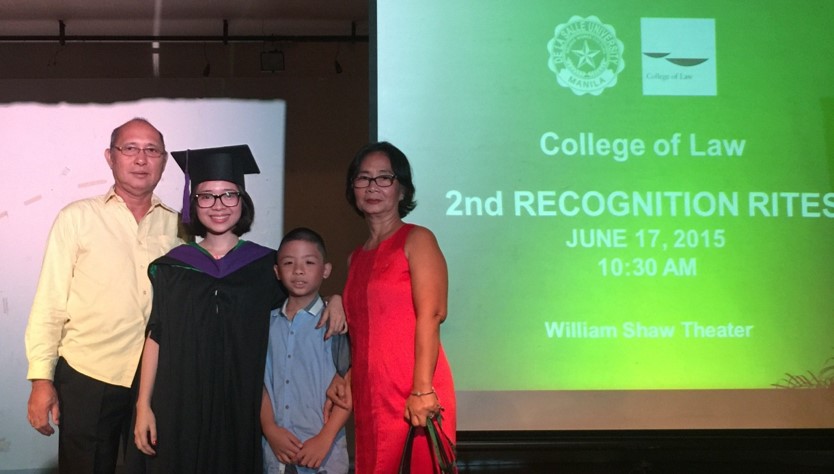

Regine was then able to go to law school, again at De La Salle University. She recently graduated as the top 4 student in her class, and will be taking the Bar exam in November. She aspires to specialize in family law and join one of the largest law firms in the country.

“I’m so thankful to my mother for giving me the opportunity to pursue my dreams,” a clearly emotional Regine affirmed. “Our family is a clear example of how Philam Life touches and improves real lives. They changed the course of our lives permanently, for the better,” she concluded.

###

About Philam Life

The Philippine American Life and General Insurance Company (Philam Life) is the country’s premier life insurance company. Established on June 21, 1947, Philam Life offers an extensive line of products in the industry that provides solutions to various financial needs including life protection, health insurance, savings, education, retirement, investment, group and credit life insurance.

Philam Life is a member of AIA Group Limited, the largest independent publicly listed pan-Asian life insurance group.

About AIA

AIA Group Limited and its subsidiaries (collectively “AIA” or the “Group”) comprise the largest independent publicly listed pan-Asian life insurance group. It has a presence in 18 markets in Asia-Pacific – wholly-owned branches and subsidiaries in Hong Kong, Thailand, Singapore, Malaysia, China, Korea, the Philippines, Australia, Indonesia, Taiwan, Vietnam, New Zealand, Macau, Brunei, a 97 per cent subsidiary in Sri Lanka, a 26 per cent joint venture in India and representative offices in Myanmar and Cambodia.

The business that is now AIA was first established in Shanghai over 90 years ago. It is a market leader in the Asia-Pacific region (ex-Japan) based on life insurance premiums and holds leading positions across the majority of its markets. It had total assets of US$167 billion as of 30 November 2014.

AIA meets the long-term savings and protection needs of individuals by offering a range of products and services including life insurance, accident and health insurance and savings plans. The Group also provides employee benefits, credit life and pension services to corporate clients. Through an extensive network of agents, partners and employees across Asia-Pacific, AIA serves the holders of more than 28 million individual policies and over 16 million participating members of group insurance schemes.

AIA Group Limited is listed on the Main Board of The Stock Exchange of Hong Kong Limited under the stock code “1299” with American Depositary Receipts (Level 1) traded on the over-the-counter market (ticker symbol: “AAGIY”).