Health

Get coverage for expensive health setbacks so you can focus on getting better.

{{title}}

{{label}}28 July 2016

HONG KONG, 28 July 2016 – The Board of Directors of AIA Group Limited (“AIA”; or the “Company”; stock code: 1299) is pleased to announce the Group’s unaudited consolidated results for the six months ended 31 May 2016.

Record growth in value of new business (VONB) (on a constant exchange rate basis)

Strong operating profit growth (on a constant exchange rate basis)

Robust cash flow and capital position

Progressive interim dividend

Mark Tucker, AIA’s Group Chief Executive and President, said:

“AIA has delivered an excellent set of results with record VONB growth of 37 per cent on a constant exchange rate basis in the first half. The strength of this performance reflects the disciplined execution of our growth strategy, the resilience of our operating model and our commitment to building a high-quality, sustainable business for the long term. This has enabled us to deliver a strong and consistent track record of year-on-year growth notwithstanding an uncertain global macroeconomic and capital market environment.

“Asia is the most attractive and dynamic region in the world for life insurance. We are operating in markets that continue to offer sustainable economic growth, increased disposable incomes, powerful demographic and urbanisation trends and very low insurance penetration rates. AIA is exceptionally well placed to benefit directly from these significant and robust drivers of life insurance growth across our region. We have a highly-diversified and resilient business model underpinned by our market-leading brand and the financial strength to enable us to capture these opportunities.

“Our focus remains on executing our strategic priorities aimed at expanding the reach and increasing the effectiveness of our proprietary agency and partnership distribution channels. We shall continue to find innovative ways to broaden our range of products and provide customers with the critically important protection and savings support they need.

“The Board has declared a 17 per cent increase in the interim dividend for 2016. This demonstrates once again our strong financial performance and our confidence in the future outlook for the Group. The consistent execution of our strategy and the strong fundamentals in the region will enable us to continue to generate sustainable value for our shareholders.”

- End -

About AIA

AIA Group Limited and its subsidiaries (collectively “AIA” or the “Group”) comprise the largest independent publicly listed pan-Asian life insurance group. It has a presence in 18 markets in Asia-Pacific – wholly-owned branches and subsidiaries in Hong Kong, Thailand, Singapore, Malaysia, China, Korea, the Philippines, Australia, Indonesia, Taiwan, Vietnam, New Zealand, Macau, Brunei, a 97 per cent subsidiary in Sri Lanka, a 49 per cent joint venture in India and representative offices in Myanmar and Cambodia.

The business that is now AIA was first established in Shanghai almost a century ago. It is a market leader in the Asia-Pacific region (ex-Japan) based on life insurance premiums and holds leading positions across the majority of its markets. It had total assets of US$181 billion as of 31 May 2016.

AIA meets the long-term savings and protection needs of individuals by offering a range of products and services including life insurance, accident and health insurance and savings plans. The Group also provides employee benefits, credit life and pension services to corporate clients. Through an extensive network of agents, partners and employees across Asia-Pacific, AIA serves the holders of more than 29 million individual policies and over 16 million participating members of group insurance schemes.

AIA Group Limited is listed on the Main Board of The Stock Exchange of Hong Kong Limited under the stock code “1299” with American Depositary Receipts (Level 1) traded on the over-the-counter market (ticker symbol: “AAGIY”).

Contacts

Investment Community

| Paul Lloyd | +852 2832 6160 |

| Yan Guo | +852 2832 1878 |

| Feon Lee | +852 2832 4704 |

| Joel Lieginger | +852 2832 4703 |

News Media

| Stephen Thomas | +852 2832 6178 |

| Emerald Ng | +852 2832 4720 |

APPENDIX

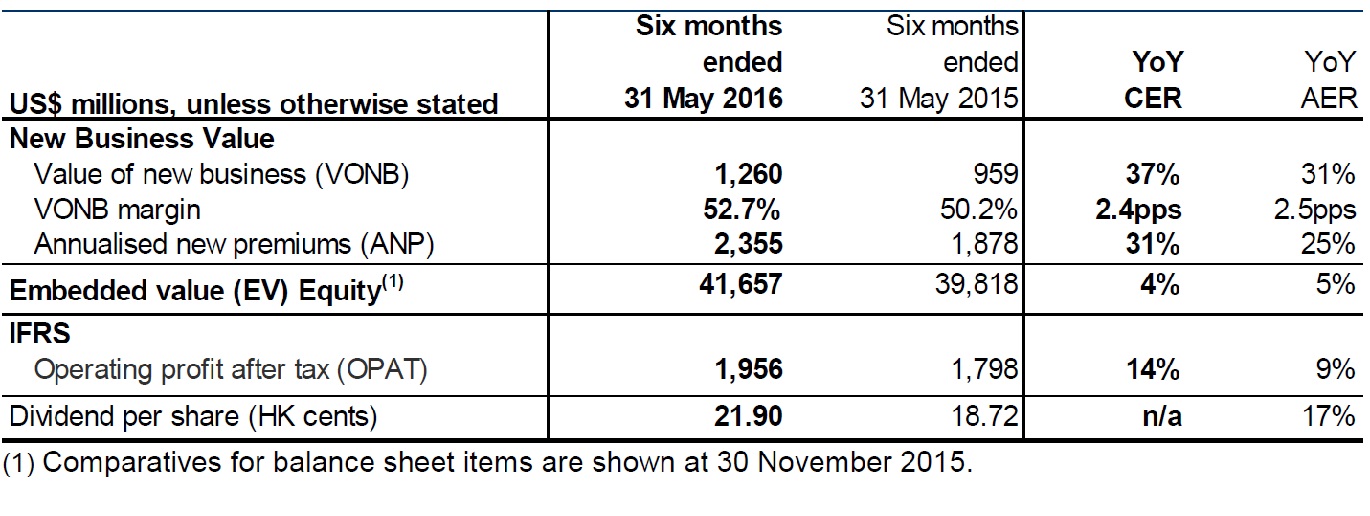

Financial Summary

Key Performance Highlights

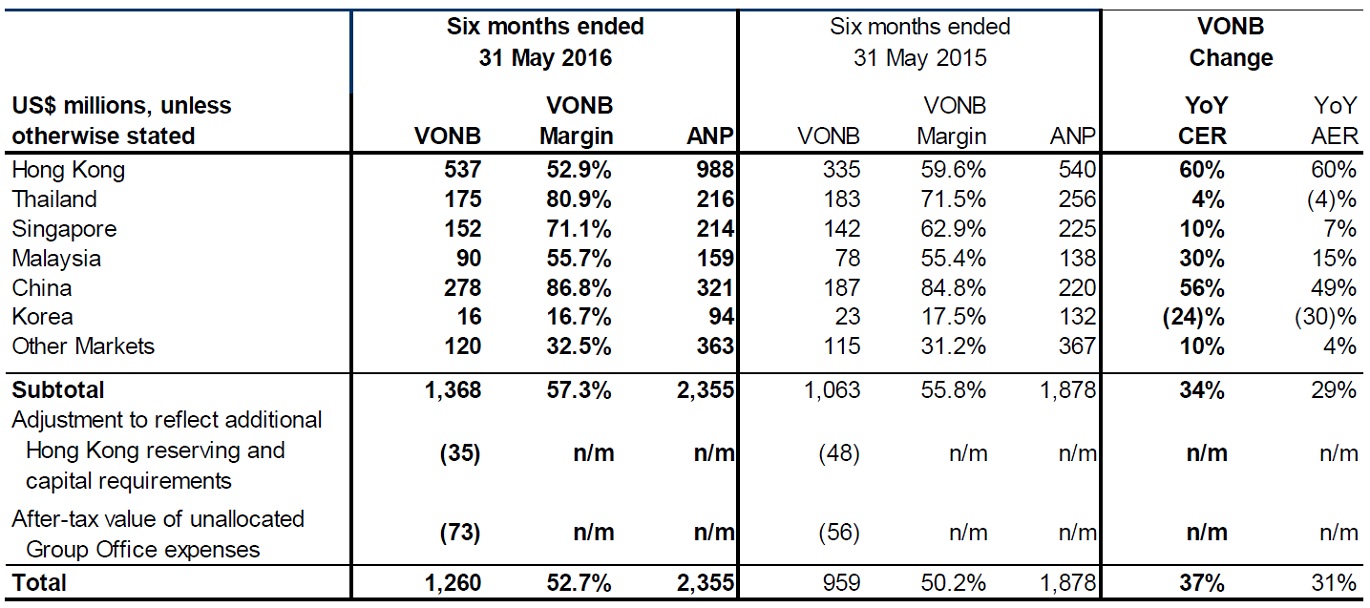

New Business Performance by Segment

Notes:

This document contains forward-looking statements relating to AIA Group Limited that are based on the beliefs of the Group’s management as well as assumptions made by and information currently available to the Group’s management. These forward-looking statements are, by their nature, subject to significant risks and uncertainties. When used in this document, the words “will”, “future” and similar expressions are intended to identify forward-looking statements. You are strongly cautioned that reliance on any forward-looking statements involves known and unknown risks and uncertainties. Actual results and events may differ materially from information contained in the forward-looking statements.

This document is for information purposes only and does not constitute an invitation or offer by any person to acquire, purchase or subscribe for securities. This document is not, and is not intended to be, an offer of securities for sale in the United States. The securities of AIA Group Limited have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”) and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements under the U.S. Securities Act. There is not, and is not intended to be, any public offering of such securities in the United States.