Health

Get coverage for expensive health setbacks so you can focus on getting better.

{{title}}

{{label}}23 October 2018

AIA Healthy Living Index 2018 shows more Filipinos behaving more healthily

MANILA, PHILIPPINES – AIA Group (AIA), Philam Life’s Hong Kong-based parent company,revealed in a study that Filipinos face a considerable “financing gap” where savings, current levels of insurance and government health provisions may not be enough to pay for the treatment for critical illnesses (such as cancer, heart disease, diabetes or other serious conditions).

The findings are part of the latest AIA Healthy Living Index Survey (The Study), the fourth since 2011, which highlights the prevailing health trends, motivations and concerns for individuals and communities across Asia-Pacific.

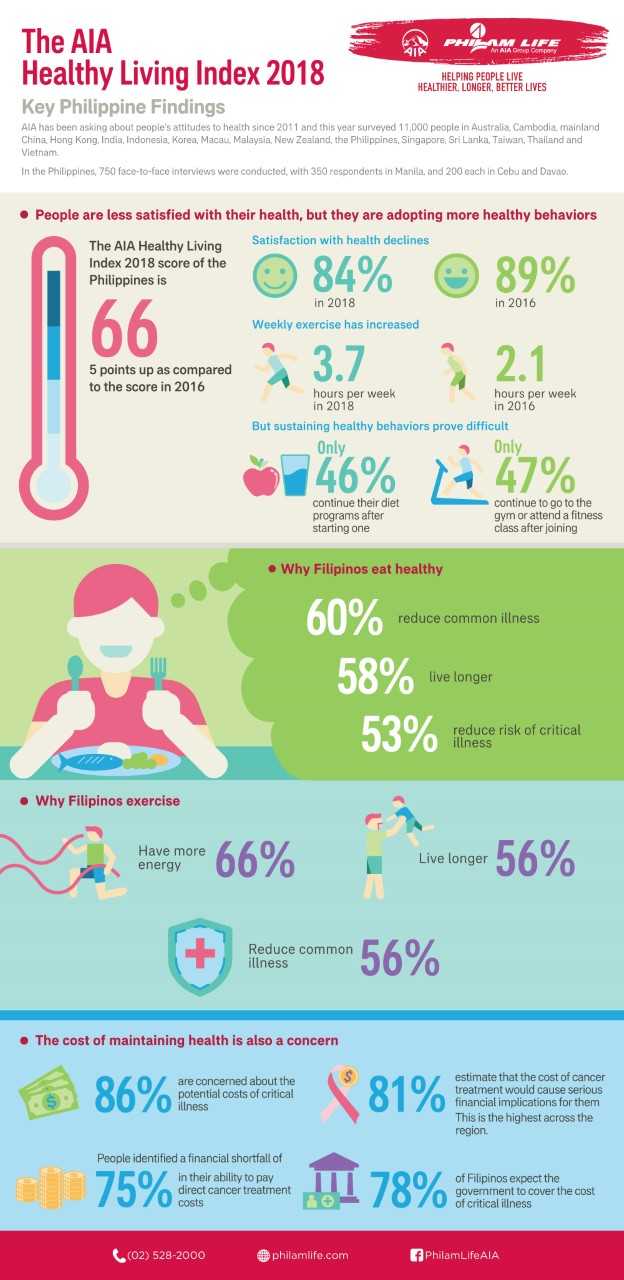

According to The Study, 86% of Filipinos are concerned about the potential costs of critical illness. When asked to estimate the cost of treatment for cancer they expect they would have to bear, over 81% estimate that the cost would have serious financial implications for them.

The concern is justified when the expected financing gap is taken into account. For cancer treatment, respondents expect an average shortfall of 75% of the costs they would have to bear. Across all respondents in the Philippines, the financing gap for heart disease is 67% and for diabetes 55% of direct costs. When asked how they will pay for the treatment of critical illness given the financing gap, 78% cited the government while 56% said charities or trust. Only 27% said this will be covered by their own personal savings and even lower at 19%, by an insurance plan.

Overall, the Philippines’ Healthy Living Index (Index) ranking went up by five points, from 61 to 66, recording the highest increase among all the AIA markets where the study was conducted. The Index is a composite score of satisfaction with one’s health and frequency of practicing healthy behavior based on six key behavior components.

Because four of the six identified behavior components reflected increasing scores (Figure 1): desire to lose weight, number of healthy activities done within the past four weeks, hours spent on exercise, availed medical checkup in the past 12 months, it can be inferred that the notable decline of overall satisfaction on health is indicative of Filipinos’ changing expectations about ideal healthy lifestyles and behaviors as well as changing habits.

Figure 1

Healthy habits can be hard to sustain. Only 46% of those who have ever tried a diet program continueto use one now. Only 47% of those who have ever joined a gym or fitness class have gone to one in the past four weeks. When asked why they eat more healthy food and do exercise, living longer ranked second for both questions.

“Two key findings from the Healthy Living Index confirm that we are on the right track: the financing gap for critical illness and the motivation for healthy behavior. With the recent launch of Active Joint Critical Protect, our groundbreaking insurance product for two that addresses health and protection concerns, we are clearly filling a need among our customers,” said Leo Tan, Philam Life Chief Marketing Officer. “When we launched the #LiveBetter campaign last year, we wanted to encourage Filipinos to take the first step to living better. Now that it’s becoming a challenge to sustain the healthy behaviors that they’ve started, we released the WhatsYourWhy campaign which we hope will motivate them to continue. But more than providing inspiration, we have the actual tool to help them continue living healthily with Philam Vitality, by rewarding them for knowing and improving their health. At the end of the day, we are doing these to help our customers live healthier, longer and better lives,” he added.

###

Please see the full regional report for more detail on the research findings by clicking on the following link: https://www.aia.com/en/healthy-living/aia-healthy-living-index.html.

The AIA Healthy Living Index surveyed 11,000 adults in 16 of the 18 AIA markets and was commissioned by AIA and conducted by IPSOS, a leading consumer research company.

About the AIA Healthy Living Index

The 2018 AIA Healthy Living Index is the fourth Asia-Pacific wide survey on health and wellbeing AIA has conducted since 2011.

The survey findings highlight prevailing health trends and indicate areas in which individuals and communities can move towards sustaining more healthy lifestyles.

The Asia-Pacific region is experiencing rapid growth in demand for quality healthcare that outstrips the development of resources and infrastructure. This phenomenon is creating significant opportunities for innovative technology and healthcare funding solutions to improve the quality and availability of care across the region.

For the 2018 Index we carried out surveys among 11,000 adults in 16 of our markets — Australia, Cambodia, mainland China, Hong Kong, India, Indonesia, Korea, Macau, Malaysia, New Zealand, the Philippines, Singapore, Sri Lanka, Taiwan, Thailand and Vietnam.

In addition to producing the AIA Healthy Living Index itself, which measures consumers’ satisfaction with their health and wellness

behaviors, the 2018 Survey had several additional objectives. In each market, we wanted to find out:

Learn more by following this link: https://www.aia.com/en/healthy-living/aia-healthy-living-index.html

About Philam Life

The Philippine American Life and General Insurance Company (Philam Life) is the country’s premier life insurance company. Established on 21 June 1947, Philam Life has earned the trust of customers for its financial strength, strong brand name, and ability to deliver on its promises.

Philam Life has PHP251.4 billion in total assets as of 31 December 2017, while serving almost 600,000 individual policyholders and over 2,200,000 insured group members.

Philam Life understands the needs of its customers and provides holistic solutions that include life protection, health insurance, savings, education, retirement, investment, group, and credit life insurance. It also offers bancassurance and fund management products and services through its subsidiaries—BPI-Philam Life Assurance Company (BPLAC) and Philam Asset Management Inc. (PAMI).

Philam Life is a member of AIA Group Limited, the largest independent publicly listed pan-Asian life insurance group.

About the Philam Group

The Philam Group comprises the biggest life insurance company in the Philippines. By putting its customers at the center of its operations, the Philam Group has earned the trust of its stakeholders and has achieved continued growth over the years.

The Philam Group was formed with the mission of empowering Filipinos to achieve financial security and prosperity. Through its strong network, it is able to offer financial solutions such as life protection, health insurance, savings, education, retirement, investment, group and credit life insurance, and fund management products and services.

After the establishment of Philam Life in 1947, the Philam Group has since expanded to include other affiliate companies, namely: BPIPhilam Life Assurance Company (BPLAC), Philam Asset Management Inc. (PAMI), Philam Call Center, and Philam Foundation.

Based on the Insurance Commission results as of 31 December 2017, the combined total premium income of Philam Life and BPLAC is at PHP40.2 billion, making it the market leader in the Philippines based on total premium income. Its strength and stability is further solidified with its top rank in terms of assets at PHP251.4 billion and net worth at PHP69.5 billion. It is a member of AIA Group Limited, the largest independent publicly listed pan-Asian life insurance group.

About AIA

AIA Group Limited and its subsidiaries (collectively “AIA” or the “Group”) comprise the largest independent publicly listed pan-Asian life insurance group. It has a presence in 18 markets in Asia-Pacific – wholly-owned branches and subsidiaries in Hong Kong, Thailand, Singapore, Malaysia, China, Korea, the Philippines, Australia, Indonesia, Taiwan, Vietnam, New Zealand, Macau, Brunei, Cambodia, a 97 per cent subsidiary in Sri Lanka, a 49 per cent joint venture in India and a representative office in Myanmar.

The business that is now AIA was first established in Shanghai almost a century ago. It is a market leader in the Asia-Pacific region (ex-Japan) based on life insurance premiums and holds leading positions across the majority of its markets. It had total assets of US$216 billion as of 30 November 2017.

AIA meets the long-term savings and protection needs of individuals by offering a range of products and services including life insurance, accident and health insurance and savings plans. The Group also provides employee benefits, credit life and pension services to corporate clients. Through an extensive network of agents, partners and employees across Asia-Pacific, AIA serves the holders of more than 30 million individual policies and over 16 million participating members of group insurance schemes.

AIA Group Limited is listed on the Main Board of The Stock Exchange of Hong Kong Limited under the stock code “1299” with American Depositary Receipts (Level 1) traded on the over-the-counter market (ticker symbol: “AAGIY”).

Media Contact:

Abbie L. Remo

Philam Life Head of Corporate Communications and PR

Telephone: (02) 8 521 6300 local 2812

Email: Abbie-D.Remo@aia.com