Health

Get coverage for expensive health setbacks so you can focus on getting better.

{{title}}

{{label}}Health · Critical Illness · Life Insurance · Coverage from 0-100

Issue Age

Critical Illness Coverage

You can buy this via

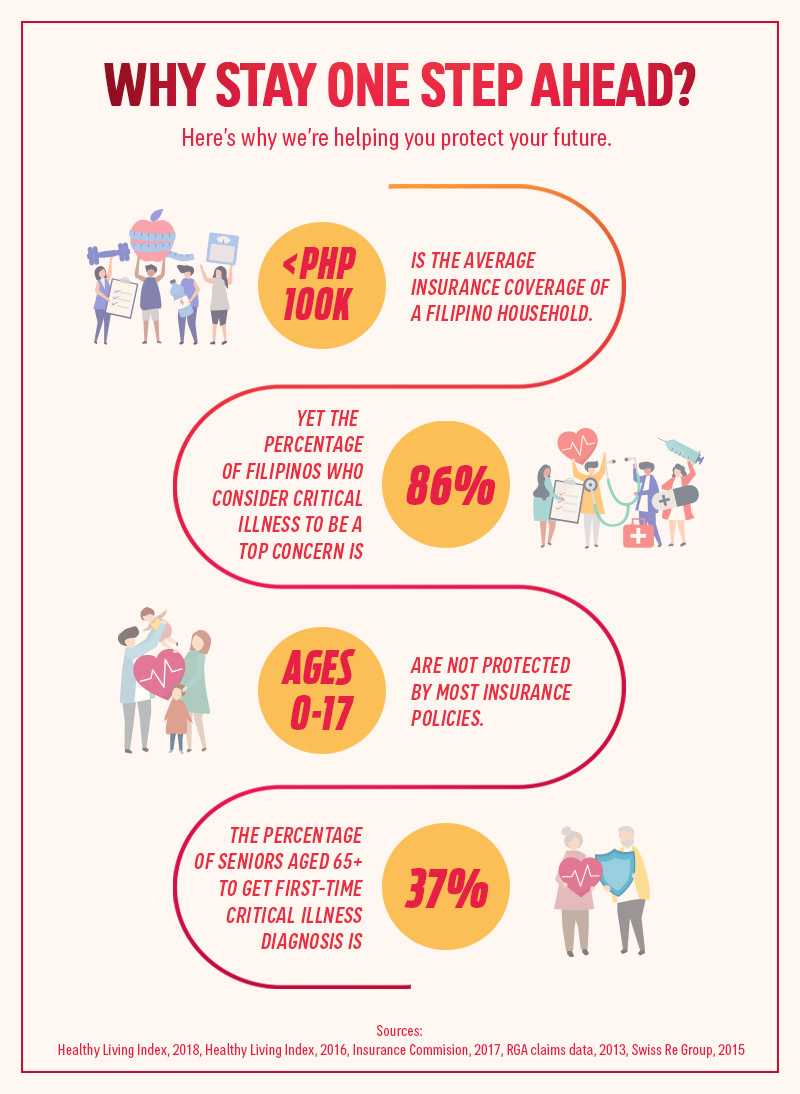

In order to give your family the utmost protection for them and their future, you need a plan that protects you too. Stay one step ahead with AIA Critical Protect 100 -- a plan that protects you against 100 critical illnesses, from age 0 to 100. Further secure and protect your future and improve your coverage by adding a Gender-Specific Cancer rider and a Recovery Benefit rider.

Because your benefits are not affected by market risks, rest assured that you get full protection when you need it.

Some critical illnesses occur early, and some just come with old age. Good thing, AIA Critical Protect 100 is a plan that lets you stay one step ahead as it protects you against 100 illnesses, starting from age 0 until 100.

Learn More About Critical Illness Coverage

Because AIA Critical Protect 100 is powered by AIA Vitality, not only are you protected against illnesses, but you can also enjoy access to a total wellness program to help you know your health, improve your health, and enjoy rewards throughout your wellness journey.

Learn More

What does "premium" mean?

This is the fee you pay us to protect you and your loved ones for a specified risk in a specified period of time.

What do we mean by "total disability"?

This is a condition resulting from injury or sickness wherein a person is unable to work or earn money from any occupation or business he is reasonably qualified by way of education, training or experience.

You can choose to add this optional feature below to customize your plan’s coverage.

Improve your coverage by adding a gender-specific rider that lets you receive an additional 50% benefit when you are diagnosed with gender-specific cancer (e.g. prostate cancer, cervical cancer, ovarian cancer).

Count on AIA Critical Protect 100 throughout your wellness journey from treatment to recovery. Through this rider, you can receive 5 yearly recovery cash benefits – each amounting to 10% of your main coverage. You may claim the first payout one year after the major claim.

In case of Payor's death or total disability, rest assured that all future premium payments for juvenile* policies will be waived. *insured = ages 0 to 17 years old

The premium rate of the plan is the amount of payment you need to make. For Active Joint Critical Protect, this will be the same for each of the 10 years of the plan. After that and when it automatically renews for another 10 years, you will have a new premium rate and it will be based on the age of both you and your loved one at the time of renewal.

Automatic Renewal means that it covers both you and your loved one for the first 10 years, and, barring a critical illness or a death claim, will continue to cover you for the succeeding 10 at an adjusted premium rate. The renewal will continue every 10 years.