Health

Get coverage for expensive health setbacks so you can focus on getting better.

{{title}}

{{label}}31 May 2018

MANILA, PHILIPPINES – “At what age do you plan to retire?” This is a familiar question we all have encountered multiple times. At first glance, it would seem easy to respond with our ideal age, or something along the lines of “as soon as I can”. But as you grow older or inch closer to that number, you’ll realize that the question is far more complex than you think. You may have toyed around with the ideal scenario in your head but in reality, the answer would depend on how ready you are for the future.

As you prepare for the big “R”, here are some tips to help you future-proof your financial goals:

1. Identify your goals

Goal-setting is key to a financially secure future. Figure out what matters to you: retiring early? Buying a house? Paying off debts? Know your priorities and be realistic about them. When thinking about your ideal retirement age, consider all factors that will come into play the moment you retire and examine all scenarios carefully. It also helps to have a sense of foresight. Having visibility on how future events can unfold will give you clearer direction on what you should plan for.

2. Commit to your goals

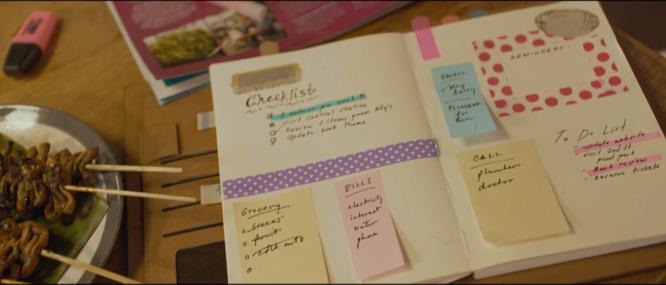

Commitment is all about taking concrete steps to achieve your goals. Once you’ve identified them it’s always helpful to list them down in a spreadsheet or a notepad. That way, you can keep track of your progress, have a clear vision of where you are headed, and take note of all the next action steps. In the financial sense, one way of committing to your priorities is making the necessary investments to cover for your goals whether they may be for short, medium, or long term.

3. Invest in assets that will give you potential returns

An investment is a commitment of funds made in expectation of some positive future return. If undertaken properly, the return will be more than the risk assumed. With the variety of investment options available today, one can never run out of possibilities to create income for a more secure future. It’s also important to have the right mentality when it comes to investing. When you generate income, you can set aside a percentage and reinvest it in assets that will give you passive income in the future. That way, you ensure regular investments and learn how to budget for your expenses.

4. Diversify! Don’t put your eggs in one basket

Any investment comes with a corresponding risk. As daunting as it may seem, there’s always a way to reduce your bad luck. One way to mitigate it and to make sure that you hedge those risks is to make several bets. Buying stocks may be the most uncertain of all given the volatility of the market, but it’s also the quickest way to obtain yields. On the other hand, long-term investments like mutual funds may take several years to bear fruit, but it’s also your safest bet to ensure that your money keeps growing. You also have the option to take a more balanced approach by putting your money in investment products with an insurance component. You can be one step ahead by protecting your family from untoward events in the future with an insurance policy. Keeping track of multiple investments may seem like hard work, but it’s having stakes in diversified channels that will result in profits many times over.

5. Craft your game plan and follow through

For something like investments that requires your utmost commitment, it’s always best to start with a game plan. Knowing where you are now from a financial perspective, and where you want to be a few years down the line is a great first step to identifying how you’ll get there. But more than just planning, the key part of reaching your financial goals is to act upon it. Research on the different types of investments, by reading articles online, attending seminars and workshops, and consulting with experts. Finding the best types of investment for you, and actually putting in the money and work into it is the only way your money can start working for you.

Find out how you can future-proof your goals and be one step ahead today by discovering your financial needs. Check out Philam Life’s Financial Needs Calculator at https://www.philamlife.com/en/financial-needs-calculator.html?cmpid=redirect-ph-fnc-2555!

###

About Philam Life

The Philippine American Life and General Insurance Company (Philam Life) is the country’s premier life insurance company. Established on 21 June 1947, Philam Life has earned the trust of customers for its financial strength, strong brand name, and ability to deliver on its promises.

Philam Life has PHP251.4 billion in total assets as of 31 December 2017, while serving almost 600,000 individual policyholders and over 2,200,000 insured group members.

Philam Life understands the needs of its customers and provides holistic solutions that include life protection, health insurance, savings, education, retirement, investment, group, and credit life insurance. It also offers bancassurance and fund management products and services through its subsidiaries—BPI-Philam Life Assurance Company (BPLAC) and Philam Asset Management Inc. (PAMI).

Philam Life is a member of AIA Group Limited, the largest independent publicly listed pan-Asian life insurance group.

About the Philam Group

The Philam Group comprises the biggest life insurance company in the Philippines. By putting its customers at the center of its operations, the Philam Group has earned the trust of its stakeholders and has achieved continued growth over the years.

The Philam Group was formed with the mission of empowering Filipinos to achieve financial security and prosperity. Through its strong network, it is able to offer financial solutions such as life protection, health insurance, savings, education, retirement, investment, group and credit life insurance, and fund management products and services.

After the establishment of Philam Life in 1947, the Philam Group has since expanded to include other affiliate companies, namely: BPI-Philam Life Assurance Company (BPLAC), Philam Asset Management Inc. (PAMI), Philam Call Center, and Philam Foundation.

Based on the Insurance Commission results as of 31 December 2017, the combined total premium income of Philam Life and BPLAC is at PHP40.2 billion, making it the market leader in the Philippines based on total premium income. Its strength and stability is further solidified with its top rank in terms of assets at PHP251.4 billion and net worth at PHP69.5 billion. It is a member of AIA Group Limited, the largest independent publicly listed pan-Asian life insurance group.

About AIA

AIA Group Limited and its subsidiaries (collectively “AIA” or the “Group”) comprise the largest independent publicly listed pan-Asian life insurance group. It has a presence in 18 markets in Asia-Pacific – wholly-owned branches and subsidiaries in Hong Kong, Thailand, Singapore, Malaysia, China, Korea, the Philippines, Australia, Indonesia, Taiwan, Vietnam, New Zealand, Macau, Brunei, Cambodia, a 97 per cent subsidiary in Sri Lanka, a 49 per cent joint venture in India and a representative office in Myanmar.

The business that is now AIA was first established in Shanghai almost a century ago. It is a market leader in the Asia-Pacific region (ex-Japan) based on life insurance premiums and holds leading positions across the majority of its markets. It had total assets of US$216 billion as of 30 November 2017.

AIA meets the long-term savings and protection needs of individuals by offering a range of products and services including life insurance, accident and health insurance and savings plans. The Group also provides employee benefits, credit life and pension services to corporate clients. Through an extensive network of agents, partners and employees across Asia-Pacific, AIA serves the holders of more than 30 million individual policies and over 16 million participating members of group insurance schemes.

AIA Group Limited is listed on the Main Board of The Stock Exchange of Hong Kong Limited under the stock code “1299” with American Depositary Receipts (Level 1) traded on the over-the-counter market (ticker symbol: “AAGIY”).

Media Contact:

Abbie L. Remo

Philam Life Head of Corporate Communications and PR

Mobile no. +63(917) 6268058

Email: Abbie-D.Remo@aia.com